$5M valuation cap as of 8/1/2020 $2.00 per-share. Offering up to 25% of total outstanding shares

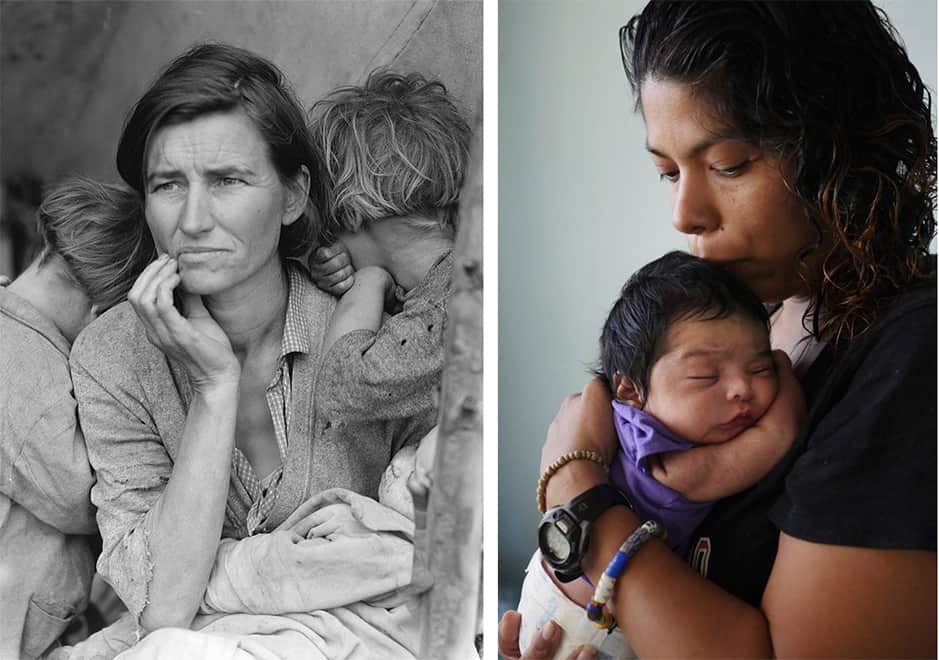

Save Families and Children

Creating Durable Homes that last for decades

A local and national solution for low-income and homeless families

A local and national solution for low-income and homeless families

$5M valuation cap as of 8/1/2020 $2.00 per-share. Offering up to 25% of total outstanding shares

54% of US employed people are just one paycheck from being homeless. Those that have no families or support system do not recover and end up homeless.

GET HIM A HOME | LEND HIM A HAND

Single parent families are the most vulnerable group who face poverty and homelessness every day. These families need a single family home to recover.

GET THEM A HOME | GET THEM SAFE

As of July 2020 there are 151,000 homeless people living on the streets of Los Angeles and another 68,000 living on the streets of San Francisco.

PLACE IN HOMES | GET THEM HEALTHY

DLS supports non-governmental organizations or NGOs that work to help aid and feed the homeless and educate the children. NGOs are a subgroup of organizations founded by citizens, which include churches, clubs and associations.

Unlike all other Homeless and Low-income housing programs, DLS is a complete package that includes:

– City wide pre-launch local and national promotions public communications social, websites, radio, TV and media

– Fast turn around land and community housing and facilities financing

– Fast construction of manufactured mobile housing

– Fast build out of community facilities and grounds

– Sponsorship and support of electronics, solar systems, home security and more

– Immediate onsite construction management

DLS is in the business of developing Homeless and Low-income Communities for cities across America

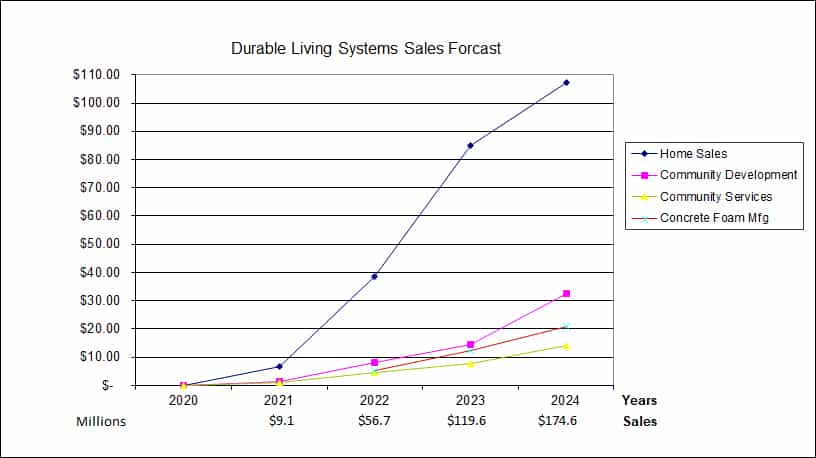

DLS is a for profit company receiving multiple income streams from three main income sources:

– Developing and building Homeless and Low-income communities

– Servicing and supporting it’s Homeless and Low-income communities

– Manufacturing Concrete Foam Construction panels for the mobile home and traditional construction

With this approach, we are on track to reach $9.1M in annual revenue by Qtr 4 2021, when we also expect to be cash flow positive

DLS uses its income to build houses and offer more assistance for the homeless and low-income families in the US

California now has 151,000 people experiencing homelessness, more than any other state in the nation

DLS has the immediate potential to help the homeless by providing 2,000 concrete foam homes in Los Angeles by 2022 helping nearly 3,200 people

DLS can create as many as 5 communities with over 18,000 home by 2025 making it the largest producer of homes in the United States providing rotational living for nearly 36,000 homeless people

The focus of community and home building will initially be in the South West helping the largest number of homeless and low income people with housing needs

Most government low cost and homeless shelters seem to start strong and end in confusion and defunding.

DLS has established a complete end to end program that asks local government to participate in 2 ways.

– #1 local government would sell land parcels at $100.00 or favorable pricing to be used for the development of homeless community(s).

– #2 local government will purchase community when completed via a long term loan with monthly payments.

Investors and celebrity investors will receive monthly payments with a guaranteed 30% return on their investment with the right to sell and transfer their shares and payment account at anytime.

Additional Investor revenue streams are available for special projects and monthly support programs.

$5M valuation cap as of 8/1/2020 $2.00 per-share. Offering up to 25% of total outstanding shares and a minimum investment of $5,000

Founder | Mr. Cashen has been in the automotive industry over 35 years and was responsible for building a successful OEM engineering, manufacturing and technical services Robotics Controls company. He has broad experience with automotive robotics technology creating vehicle production facilities and production software and control systems. For 10 years, his philanthropic efforts have been focused on the Tesla Foundation, an international organization founded for the purpose of educating visionaries, designers, engineers and entrepreneurs of the importance in managing artificial intelligence.

Founder | Mr. Cashen has been in the automotive industry over 35 years and was responsible for building a successful OEM engineering, manufacturing and technical services Robotics Controls company. He has broad experience with automotive robotics technology creating vehicle production facilities and production software and control systems. For 10 years, his philanthropic efforts have been focused on the Tesla Foundation, an international organization founded for the purpose of educating visionaries, designers, engineers and entrepreneurs of the importance in managing artificial intelligence.

Founder | Eddy Pham is a nationally prominent expert in the D2C industry, providing product development and campaign management services ranging from idea conception to revenue generation. Within his career he has helped bring over 150 products to market generating billions in sales since 1993. In his almost three decades of business development Mr. Pham is well versed in product development, source manufacturing and overall operational business management. Each and every campaign he has worked on has been a hands-on approach. Mr. Pham grew up working in family restaurants and then started his career in the transactional marketing industries (infomercials) at age 23.

Founder | Eddy Pham is a nationally prominent expert in the D2C industry, providing product development and campaign management services ranging from idea conception to revenue generation. Within his career he has helped bring over 150 products to market generating billions in sales since 1993. In his almost three decades of business development Mr. Pham is well versed in product development, source manufacturing and overall operational business management. Each and every campaign he has worked on has been a hands-on approach. Mr. Pham grew up working in family restaurants and then started his career in the transactional marketing industries (infomercials) at age 23.

Frequently Asked Questions

Click below to visit http://durablelivingsystems.com/ and read more about the Durable Living Systems

complete program

© All Rights Reserved

Regional Managers reach out to as many locations as possible where you may find people that need funding to operate or grow their business. The Tesla Foundation is in business to help keep small business owners in business and give them answers to questions that they have.

Here are some locations where you can find people that need help running and funding their business:

Tax law definitions do not apply to much of the Payroll Protection Program (PPP), making it new ground for owners of S corporations. Here are answers to four questions of concern to many S corporation owners.

1. Spouse Owns S Corporation

Question. My wife owns 100 percent of the S corporation. She has a full-time job and does no work for the S corporation. I am the sole worker in the S corporation.

Am I treated as

In tax law, you would have to consider “attribution rules” that would make you own what your wife owns because of your marital relationship. (Yes, in tax law you both would own 100 percent.)

But the PPP guidance to date contains no such rules.

According to the latest from the SBA, you may rely on the laws, rules, and guidance available at the time of your PPP loan application. As we write, the latest guidance is from over a month ago, on June 25, 2020.

2. S Corporation Owner-Employee with No W-2

Question. I submitted my PPP loan application before the guidance disallowing independent contractor payments was published. And at the time of submission, I had not yet started paying myself a salary.

Now I have the PPP money from the bank but cannot get it forgiven through contractor payments. If I pay myself on a W-2, I lack the look-back period of 2019 payroll.

Am I out of luck? Should I go on payroll and hope for the best?

Answer. Under the rules, you are out of luck. Your loan forgiveness is based on the lower of your 2019 W-2 (zero) or your 2020 W-2.

3. S Corporation Loan Based on K-1

Question. I operate my business as an S corporation with two W-2 employees other than me (I don’t receive a W-2). I applied for the PPP loan and obtained it based on my K-1.

A few weeks later the lender told me that the money I received was not available to be forgiven. It’s just not fair. My profit is my income.

Is there any workaround for this?

Answer. No—no workaround. But in your case, likely no PPP loan forgiveness problem either.

But first, let’s think about taxes. You operate as an S corporation, and you take no salary. (That’s incorrect and likely a tax problem if the IRS audits your tax return.)

Now, let’s get to the PPP. Your lender granted you the PPP loan based on the K-1 and ignored your employees. That shows how confusing the PPP has been. But let’s ignore the right and wrong of that and get to the heart of the issue. Can you obtain forgiveness?

Yes, your S corporation’s forgiveness begins with what you pay your W-2 employees during the 24-week covered period including what you pay in health insurance and retirement on their behalf.

In addition, you may include some or all of your payments for business interest, rent, and utilities during the 24 weeks beginning with receipt of the loan.

Example. Let’s say you received a $100,000 loan. If your payroll during the 24 weeks is $63,000 and the rent and utilities total $37,000, you would qualify for 100 percent forgiveness. If you achieve this in 20 weeks, you could apply for forgiveness then.

Observation. The fact that the lender based your loan on your profits is simply a mistake by the lender. It does not affect forgiveness, which is based on your using the money for the intended PPP purposes such as payroll.

4. S Corporation with Home Office

Question. Your tax guidance for the S corporation owner is for the owner to use an expense report to submit home-office expenses to the business for reimbursement and classify the reimbursement in the tax return as an office expense.

The idea behind this guidance is to avoid the rental fiasco.

How would we classify this as mortgage interest and utilities under the PPP loan forgiveness guidelines? We have the same question for partnerships where it is claimed as an unreimbursed partner expense.

Answer. The reimbursed expense won’t work for the PPP, but here’s the solution. Choose the 24-week program and you will achieve full forgiveness with only the payroll in as little as 10.8 weeks.

If you have PPP forgiveness questions, please don’t hesitate to call me.