TESLA FOUNDATION, INC.

The Tesla Foundation, a for-profit company, plays crucial roles in fostering innovation and supporting startups, small business and mid cap companies providing business development guidance, and mentorship, to optimize business models.

The foundation offers access to a network of industry leaders, investors, and key stakeholders, enabling companies to form valuable partnerships and secure funding.

Additionally, the foundation also plays a pivotal role in product development, business expertise to guide startups through business development, MVP prototyping, scaling, market readiness and growth.

nikola TESLA

We shall not satisfy ourselves simply with improving steam and explosive engines or inventing new batteries; we have something much better to work for, a greater task to fulfill, the effor of FREEDOM.

We have to evolve means for obtaining the energy of invention from stores which are forever inexhaustible, our minds. A perfect method which does not imply consumption and waste of any kind delivering only freedom and security.

Thoughts from Nikola Tesla

The TESLA Foundation's business

The Tesla Foundation

Why: Make life easier for all mankind through technology Mission: Help people create, develop and package their dream company

When in 1884 Nikola Tesla arrived in New York he brought with him a simple, powerful and actionable idea. Tesla’s “Why” (Make life easier for all mankind through technology). Here you’ll find several domains and business’ being offered by the Tesla Foundation to purchase, investment in or partner with scientists, topic enthusiasts, entrepreneurs, teachers and everyday people with an idea.

Anyone that has a high interest in making life easier for all mankind through an invention, product or service can follow Nikola Tesla’s vision for the future. So now you can partner with Tesla and give the world and beyond technology that will touch and help mankind for thousands of years.

INVENT, CREATE AND CHANGE

THE WORLD

TESLA FOUNDATION BUSINESS PORTFOLIO

nov

3

2019

INVEST $5.00 pER-SHARE

raising $5M Crowd funding

Oct

10

2015

unmanned autonomous vehicles "drones"

UAVSA was created as a link between technology, pilots-operators and clients for the development of the drone industry. The adoption of equipment technology, flight systems and payloads will add a new segment of technology and service operation to aviation.

global market focus

invest $2.00 per-share

Aug

21

2010

PURCHASE

dec

30

2019

Long lasting Low Cost new tech Homes

The Tesla Foundation is focused on delivering technology to make life easier, safer and better. Delivering technology that in this case comes through the adoption of manufacturing materials technology and the installation of control and communication electronics into low cost mobile homes.

MAJOR CITIES IN NEED OF LOW COST HOMES FOR THE HOMELESS

INVEST $5.00 pER-SHARE

Let the Tesla Foundation help you launch, fund and grow your company

Idea & Research

We work with leading entrepreneurs, universities or partners/govt. to trigger potentially leapfrog ideas in the chosen sectors. We work deeply with them to bring validated AI research to a level where it can be prototyped.

Prototype

We help prototype the research to create a product with our resources and network of EIRs (Entrepreneurs in Residence) and TIRs (Technologists in Residence). We provide capital and infra support for product design, development and distribution.

Product to market

Once the idea reaches the product market fit, we help launch it as a company along with entrepreneurs in residence, the team & strategic investors/VCs. We continue to work closely with the company post the launch as cofounders.

Scale

We help the company scale by providing capital, data sets, cutting edge AI research talent, partner network and IP access, in the growth and scale stage. This way we aim to grow a cluster of 20-25 AI companies for millions of users.

tesla foundation's

Company Client Development Team

The Tesla Foundation’s department heads have a great deal of experience in the development of business, personal skills and products. Equally, the company prides itself on its ability to find government loans and grants in a timely fashion. Today’s environment has made the need for finding extra funds to maintain operations and purchase inventory have become very important. The Tesla Foundation has created a step-by-step plan to help clients strategize, organize their company and help find funding.

THE TESLA TECHNOLOGY AWARD

The Tesla Technology is a global event representing individuals and companies for achievements in Artificial Intelligence, Blockchain software and Web 3 programs.

TESLA TECHNOLOGY AWARD

There exist thousands of awards given out to deserving people who have achieved important thresholds in history.

The Tesla Award is presented to those few individuals based on technology that such special people and companies have conceptualized. invented, developed, and commercialized.

The Tesla Award is presented for the invention of technology in segments of human existence today and in the future of life on earth and other planets.

tesla award event

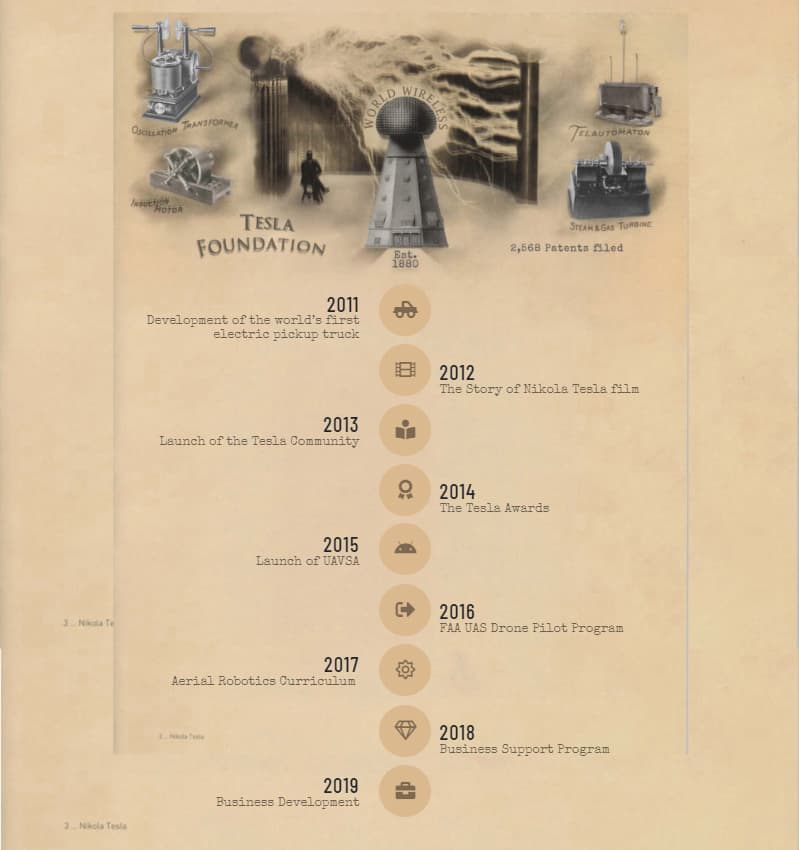

the tesla foundation history

About the Tesla Foundation

Beginning in 1884 when Nikola Tesla arrived in the United States of America the world was introduced to technology on a scale never witnessed in history. A time when man and machine were just beginning to cooperate as one to create products for the world on a mega scale. Nikola Tesla became one of the most prolific inventors of the time with inventions that will resonate for thousands of years. In celebration of Nikola Tesla’s incredible achievements and to bring awareness to a time from 1880 – 1900 when one man created such inventions that changed salivation forever. The Tesla Foundation will now carry on Nikola Tesla’s legacy by advancing technology globally through the development of business and other important commercial resources.

Tesla Productions launched Tesla Foundation.com in 2011 with the aim of uncovering insights for investing in Tesla Technology companies and the global tech economy. To provide a holistic view of technology investments and capital flow into the Tesla products, services and systems, in 2020 we expanded the Tesla Foundation website beyond just Tesla company Infrastructure, to include technology layers that provide access to other companies unlocking investment and startup opportunities.

Information and data is presented in the following pages that has been collected from a number of sources across many industries and categories, listing companies that have a need to be adopted by enthusiastic parties and grown to each of their own potential.

2024

Our Mission: The Tesla Foundation exists to help and award all people in their quests of creation.

What we do: The Tesla Foundation works directly with entrepreneurs, inventors, scientists, business owners, teachers, students and other people to own, build and create their own Tesla or other branded business.

How we do it: The Tesla Foundation staff does the hard work making it easy to for anyone to own a Tesla brand or other brand, start a new business, grow an existing one or expand a current business to the next level.

Sign up to follow tesla's OPPORTUNITIES

Stay up to date on

THE tesla FOUNDATION'S BUSINESS OPPORTUNITIES

Tesla Foundation, Inc.

Contact: [email protected] 310-467-1193 Los Angeles CA, 91406

The Tesla Foundation its companies and brands are not affiliated with Tesla, Inc. It is neither inferred nor implied that brands, businesses and products presented here are authorized by or in any way connected to Tesla, Inc.