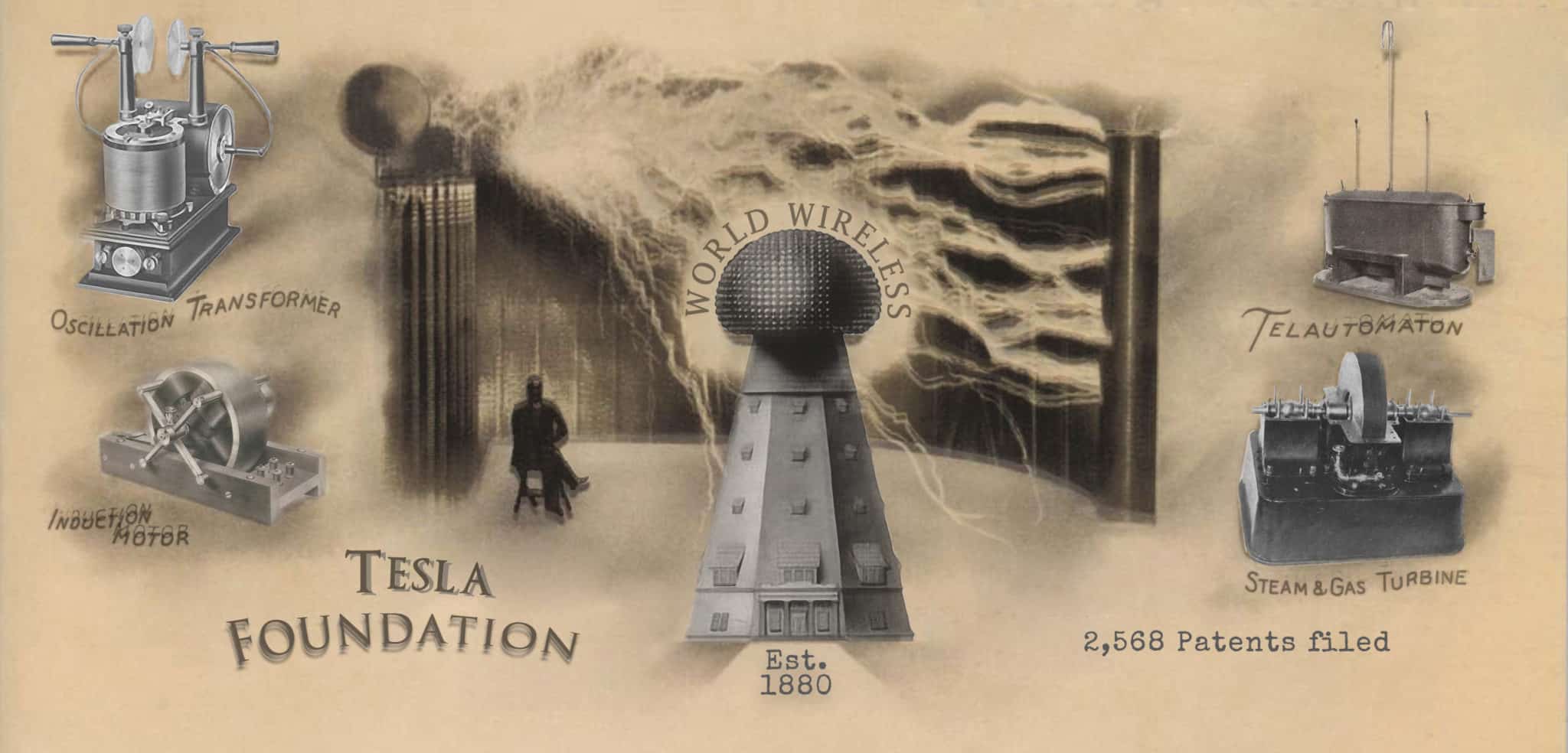

The tesla foundation is The future of online technology education

let's unite business & private equity firms to

create the greatest technology educational resource in the world

TESLA SCHOOL OF AI TECHNOLOGY

TECHNOLOGY LEADING COLLEGES DELIVERING HANDS ON LEARNING

WITHOUT ATTENDING A TRADITIONAL SCHOOL CAMPUS

WITHOUT ATTENDING A TRADITIONAL SCHOOL CAMPUS

MORE INFORMATION

TESLA LIBRARY SLM - LLM

A VAST SCIENCE AND TECHNOLOGY ONLINE GLOBAL LIBRARY

MORE INFORMATION