LIFE-CHANGING technology businesses and websites

build your business with the Tesla Foundation

HELP CHANGE THE WORLD THROUGH TECHNOLOGY

tesla FOUNDATION business Programs

build a great brand and

create a world leading TECHNOLOGY company

INVEST, PURCHASE OR PARTNER WITH THE TESLA FOUNDATION

start and operate your business and create a WORLD LEADING COMPAny

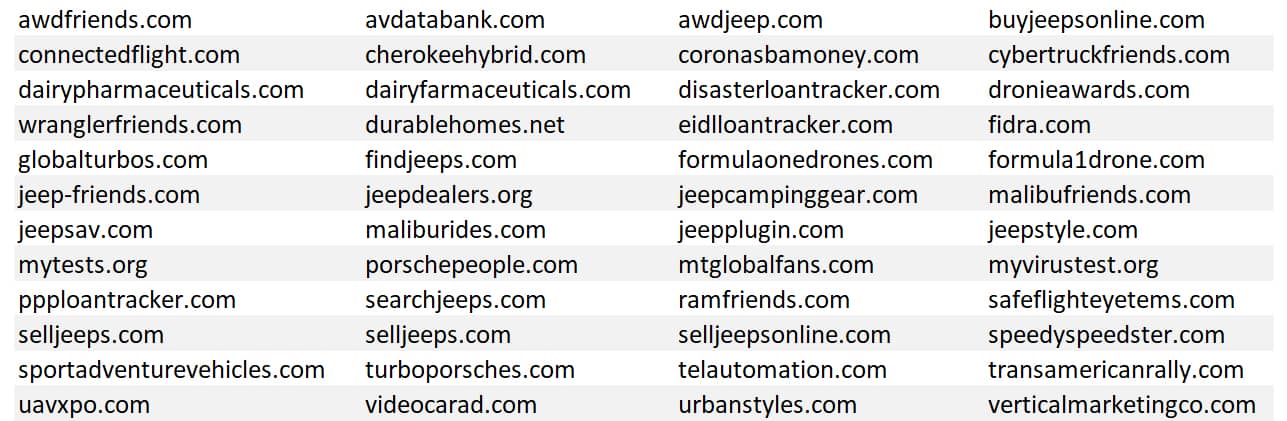

SEARCH HUNDREDS OF GREAT BUSINESSES LIKE THESE

TESLA FOUNDATION will help you

start a business

It’s your dream and the Tesla Foundation is here to help you realize it. If you have a idea, a company that you have started or is a working company. Tesla Foundation is here to help you succeed. If you want to start a company but don’t really know what the next steps are to get it moving select from one of hundreds of carefully chosen domain names or a businesses here and get started on making your business dream a reality.

FEATURED BUSINESSES THAT ARE IN HIGH DEMAND

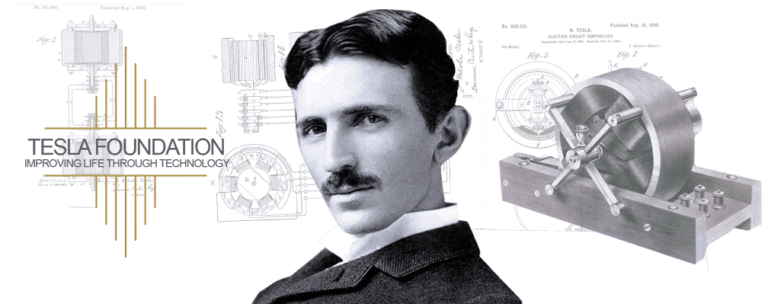

Durable Living Systems (DLS) supports the sales of the world’s only low-cost high technology integrated concrete foam modular manufactured living structures that can be assembled anywhere on earth and/or manufactured and assembled on site.

Durable Living Systems (DLS) supports the sales of the world’s only low-cost high technology integrated concrete foam modular manufactured living structures that can be assembled anywhere on earth and/or manufactured and assembled on site.

Low-cost, 80 year service life housing for low-income families and the homeless.

Primro8e, Inc. is the creator of Qmplete, the world’s wallet size credit card computer. The Qmplete Card will change the way all transactions are done globally. Primro8e is integrating transaction technology software into it’s credit card size computer. the Qomplete Card, a “micro computer” that will become the only card in your wallet. Primro8e is now offering A round investment for a minimum of $10,000.

Primro8e, Inc. is the creator of Qmplete, the world’s wallet size credit card computer. The Qmplete Card will change the way all transactions are done globally. Primro8e is integrating transaction technology software into it’s credit card size computer. the Qomplete Card, a “micro computer” that will become the only card in your wallet. Primro8e is now offering A round investment for a minimum of $10,000.

First “Wallet Size Computer” to perform all transactions and replace credit cards

Website under construction

Every lady is unique in the way she dresses and the bag and personal items she carries that represents her. To assure that the Foree woman is unique and special in every way, Foree has invented the world’s first patent luxury hand bag. The Foree Luxury Bags have a secret not only beautiful of support a hidden patent pocket has added security and privacy.

Every lady is unique in the way she dresses and the bag and personal items she carries that represents her. To assure that the Foree woman is unique and special in every way, Foree has invented the world’s first patent luxury hand bag. The Foree Luxury Bags have a secret not only beautiful of support a hidden patent pocket has added security and privacy.

The Elegant Bag that keeps all of your important items safe, wallet, phone, etc.

Website under construction

At a time where virus awareness requires excessive cleanliness and sanitation, healthy skin matters most. Now that you have to use sanitizers why not also take care of your skin with Virell the “Lotion and Soft Gel” hand and skin sanitizer. Virell is natural and made from cow’s milk one of the most natural substance on earth. FDA approved and available online and everywhere.

At a time where virus awareness requires excessive cleanliness and sanitation, healthy skin matters most. Now that you have to use sanitizers why not also take care of your skin with Virell the “Lotion and Soft Gel” hand and skin sanitizer. Virell is natural and made from cow’s milk one of the most natural substance on earth. FDA approved and available online and everywhere.

Made from Cow’s milk, Virell is the world’s natural hand lotion sanitizer.

Great businesses for

Investment, partnerships and purchase with financing

The Comfeet Blanket was created by the world famous product designer Eddy Pham. Comfeet is an amazing blanket that not only keeps your feet and body warm, it also folds into a soft pillow. Comfeet is a product of Comfeet Products, LLC.. and is the first of other personal comfort products to follow. Comfeet is ready to launch with starter inventory ready to ship.

The Comfeet Blanket was created by the world famous product designer Eddy Pham. Comfeet is an amazing blanket that not only keeps your feet and body warm, it also folds into a soft pillow. Comfeet is a product of Comfeet Products, LLC.. and is the first of other personal comfort products to follow. Comfeet is ready to launch with starter inventory ready to ship.

From the designer of the Snuggie blanket the Comfeet Blanket with “Feet” is born, Stay Warm!

Personal Protective Equipment (PPE) demand has seen a surge in the global market by 2.5 million%. In order to fulfill the rising tide of demand for PPE, PPE Sales Online.com are committed to providing products made from the finest materials to ensure optimum performance in protection, breath ability, and comfort of the user. We pride ourselves in dealing only with products that are authorized and/or registered with the FDA.

Personal Protective Equipment (PPE) demand has seen a surge in the global market by 2.5 million%. In order to fulfill the rising tide of demand for PPE, PPE Sales Online.com are committed to providing products made from the finest materials to ensure optimum performance in protection, breath ability, and comfort of the user. We pride ourselves in dealing only with products that are authorized and/or registered with the FDA.

The new norm is to “Sanitize” PPE is the immedite supplier for masks, gloves, spray and all products.

JeepFriends.com will become the largest Jeep sales online website in the next 2 years. Find here tens of thousands of new and used Jeep vehicles from dealers and private owners all over the United States. This is a great site to invest in, partner with or own.

JeepFriends.com will become the largest Jeep sales online website in the next 2 years. Find here tens of thousands of new and used Jeep vehicles from dealers and private owners all over the United States. This is a great site to invest in, partner with or own.

The online Jeep only dealership/Jeep Store for anyone that love Jeeps of all years and models.

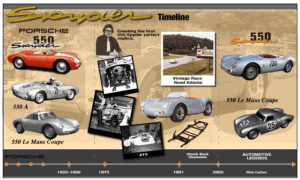

We all know and love PORSCHE. Daily people from around the world own enjoy and drive them. Porschepeople.com and Porschefriends.com allows all enthusiasts, owners and admirers to find one another and talk sell and buy PORSCHE.

We all know and love PORSCHE. Daily people from around the world own enjoy and drive them. Porschepeople.com and Porschefriends.com allows all enthusiasts, owners and admirers to find one another and talk sell and buy PORSCHE.

A car cult like never befor Porsche People-Friends love Porsche, talk about Porsche, have friends that love and own Porsche. Porsche Friends is a resource for all things Porsche.

Website under construction

UAVSA, Unmanned Aerial Vehicle Systems Association was created in 2014 to meet the demand of the FAA requirements for UAS-Drone operators, flying Drones for commercial use in the US. In 2015 UAVSA staged the first Drone event in the US bringing together thousands of Drone enthusiasts. UAVSA now focuses on every aspect of Drone flight from 0 AGL to 1,500 ft AGL.

UAVSA, Unmanned Aerial Vehicle Systems Association was created in 2014 to meet the demand of the FAA requirements for UAS-Drone operators, flying Drones for commercial use in the US. In 2015 UAVSA staged the first Drone event in the US bringing together thousands of Drone enthusiasts. UAVSA now focuses on every aspect of Drone flight from 0 AGL to 1,500 ft AGL.

The world’s #1 UAS Association working to develop membership knowledge in UAS design, engineering and flight systems.

Website under construction

Celebrity has always been a big draw but when you combine celebrity and garage it now delivers a new message and is in fact the name of a video series. Celebritygarage.com is a $6,618 domain name and a series that will be worth millions of dollars.

Celebrity has always been a big draw but when you combine celebrity and garage it now delivers a new message and is in fact the name of a video series. Celebritygarage.com is a $6,618 domain name and a series that will be worth millions of dollars.

The next best reality show will be less about crazy people and more about the Ride, Celebrity Garage has it all fro start to finsh. How Cool!

Website under construction

![]() SpeedySpeedster.com is built for the millions of people that love the 356 Porsche Speedster. Built from 1954 to 1957 when the 356 A 1500 GS Carrera GT Speedster the fastest production PORSCHE was unveiled. The site presents everything about the Speedster its life and legacy for enthusiasts, owners, buyers and sellers globally.

SpeedySpeedster.com is built for the millions of people that love the 356 Porsche Speedster. Built from 1954 to 1957 when the 356 A 1500 GS Carrera GT Speedster the fastest production PORSCHE was unveiled. The site presents everything about the Speedster its life and legacy for enthusiasts, owners, buyers and sellers globally.

The love of the PORSCHE 356 Speedster has been never ending. The rebirth of the Speedster from the Boxster melds the great looks of the vintage 356 with the technology and reliability of today.

Website under construction

Hot Wheels has become an evergreen brand from its launch in the 1960s. Each year Matell introduces a new collection of the little die-cast cars that become destined to be another collectors release. In 2004 a new product was created modelsandmedia.com that was designed to tell the story of how each of the Hot Wheels real vehicles came to be. Hot Wheels MM.com takes the model collector directly to the history associated with each model. Additionally, you can find the largest collection of rare Hot Wheels collector cars that are available from the membership through the website. Enjoy linking to all of the micro cars and the stories behind them.

Hot Wheels has become an evergreen brand from its launch in the 1960s. Each year Matell introduces a new collection of the little die-cast cars that become destined to be another collectors release. In 2004 a new product was created modelsandmedia.com that was designed to tell the story of how each of the Hot Wheels real vehicles came to be. Hot Wheels MM.com takes the model collector directly to the history associated with each model. Additionally, you can find the largest collection of rare Hot Wheels collector cars that are available from the membership through the website. Enjoy linking to all of the micro cars and the stories behind them.

A Hot Wheels collectors platform to enjoy collecting, communicating and watching accual car videos.

Website under construction

Operated as a retail new and used exotic car dealership in Malibu California and sold in 2009, Automotive Legends is now an online exotic and rare car retail website. The site allows enthusiasts, owners and buyers to find one another and get the special car they are in search of. Owners post their cars for sale for all the world to see daily.

Operated as a retail new and used exotic car dealership in Malibu California and sold in 2009, Automotive Legends is now an online exotic and rare car retail website. The site allows enthusiasts, owners and buyers to find one another and get the special car they are in search of. Owners post their cars for sale for all the world to see daily.

Reflecting the Malibu car collector and luxury lifestyle of Southern California living you will find it all here.

Website under construction

Today higher end automobiles can not be towed or serviced by unqualified garages. Malibu Auto Club.com is an executive service for owners of automobiles where service can only be provided by the vehicle’s franchise dealer. The service brings to it’s members a loaner car from their dealer picks up their car for service, drops off their car for service and collects it and returns it to the Malibu Auto Club member upon completion of service.

Today higher end automobiles can not be towed or serviced by unqualified garages. Malibu Auto Club.com is an executive service for owners of automobiles where service can only be provided by the vehicle’s franchise dealer. The service brings to it’s members a loaner car from their dealer picks up their car for service, drops off their car for service and collects it and returns it to the Malibu Auto Club member upon completion of service.

Your automobile, your lifestyle, your community, your home MALIBU.

Website under construction

Finding the style that reaches Malibu, Beverly Hills, Miami Beach and the urban communities that touch rich and not so famous people. From Wine to the latest crazed artist, Urban Styles online carries the best quality in background living and beach and sportswear from California and designers around the world.

Find the highest luxury brands in the world at Urban Style of Malibu the online store to the celebrities.

Website under construction

The FORD Bronco truck has become an icon with the earlier models fetching as much as $100,000. With the relaunch of the Bronco for model year 2021 Bronco Friends.com presents past and future models of this evergreen brand. Enthusiasts, owners and admirers can find Bronco meet ups, one another and buy and sell new and used Broncos. Additionally, FORD dealers can post their Bronco inventory directly in front of customers.

The FORD Bronco truck has become an icon with the earlier models fetching as much as $100,000. With the relaunch of the Bronco for model year 2021 Bronco Friends.com presents past and future models of this evergreen brand. Enthusiasts, owners and admirers can find Bronco meet ups, one another and buy and sell new and used Broncos. Additionally, FORD dealers can post their Bronco inventory directly in front of customers.

You thought it was gone for ever! The Bronco is back better than ever for 2021. Enjoy the online information and sales platform for the new Bronco.

Website under construction

Great business domains for sale to build your new business!

Watch john's speech

we'll help you build your company

tesla foundation focuses on you and your

company's success

Tesla Foundation, Inc.

Contact: [email protected] 310-467-1193 Los Angeles CA, 91406

Let the Tesla Foundation help you start and build an Amazing COMPANY

The Tesla Foundation its companies and brands are not affiliated with Tesla, Inc. It is neither inferred nor implied that brands, businesses and products presented here are authorized by or in any way connected to Tesla, Inc.